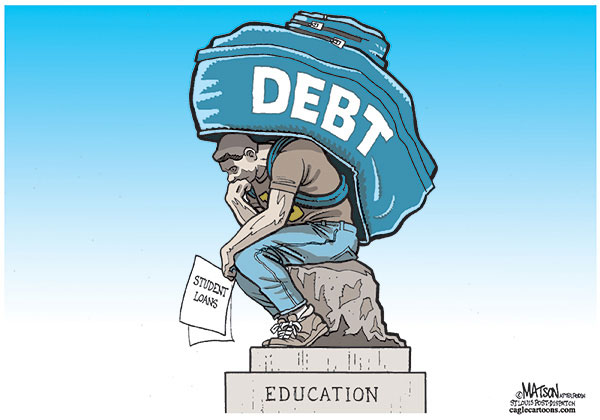

For some people, the season of giving thanks actually represents something that they aren’t all that thankful for – student debt. November and December mark the end of many student loan grace periods, which means this is the time of year when recent grads have to start paying back student loans.

If you fall into this category, here’s something you can be thankful for: a smart student loan repayment strategy. Because make no mistake – paying back student loans does require a strategy, particularly for the average graduate, law or medical school grad shouldering six figures of student loan debt.

You might think it’s as simple as choosing a student loan repayment plan and writing that first check. But variables like your monthly payment amount, the interest rates on your loans and how long you take to pay everything off can all have a big impact on your bottom line. A smart strategy optimizes these factors for your specific situation, so that you don’t spend a penny more than you have to when paying back student loans.

You can’t do anything about your grace period ending, but you can take steps to put your repayment strategy on the right track. Here are a few ways to do just that:

Know what you owe

Chances are you haven’t looked at your loans since you signed on the dotted line, so the first thing you’ll want to do is survey the damage. You can find your federal loans on the National Student Loan Data System (NSLDS). For private loans, try gathering up your statements or checking in with your school’s financial aid administrator. If you’re really at a loss, you can pull your credit report and all of your loans should be listed there.

Once you’ve tracked everything down, make a list of your loans and their important details – the type (e.g. subsidized, unsubsidized, Grad PLUS, private), the amount and the interest rate on each one. This information will be key to determining your strategy.

Read the fine print

Now it’s time to familiarize yourself with the features of each loan type. A general rule of thumb is that federal loans tend to offer more hardship-based benefits than private loans – things like forbearance, potential loan forgiveness and income-based repayment plans. It’s important to understand whether any of these benefits apply to you before determining your repayment strategy – you’ll learn why in a moment.

Private loans don’t typically offer these same types of programs, but some of them do provide forbearance and other valuable benefits – you’ll simply have to call your lender to find out. For example, SoFi offers unemployment protection for our student loan refinance borrowers, which means that for borrowers who lose their jobs through no fault of their own, we pause their payments for up to 12 months and help them find a new one.

Do the math

Remember when we said that various factors (such as interest rate, monthly payment amount and loan term) make a difference in your loan’s bottom line? This is the part where you discover just how much. Federal loans offer different student loan repayment options, allowing some flexibility around monthly payment amount and length of repayment term (e.g. 10 years vs. 20 years). While it may be tempting to just choose the option with the lowest monthly payments, the long-term repercussions can be costly.

Let’s say you have a $100,000 student loan at a fixed 6.8% interest rate. If you pay it off in 10 years, your monthly payments will be $1150.80 and the total interest will be $38,096.39. If you extend the term to 20 years, your monthly payments will go down to $763.33, but your total interest will spike to $83,201.48. If you can afford the higher monthly payments, you can save more than $45,000 in interest.

Consider your options

You may also be wondering whether to consolidate or refinance student loans. Consolidating simply means combining two or more loans into one loan, while refinancing entails applying for a new loan at a lower interest rate, then using that new loan to pay off your old loans.

If you consolidate student loans through the Direct Loan Consolidation program, only federal loans are eligible, and the main benefit is that you reduce the number of bills you have to pay each month. Direct Loan Consolidation won’t save you any money, since the resulting interest rate is a weighted average of the original loans’ rates. You can lower monthly payments by extending the payment term, but be aware that it usually means you’ll spend more on total interest.

You can also consolidate student loans through the refinance process, and some lenders will refinance both private and federal student loans. More importantly, refinancing saves you money. In order to qualify for a lower rate, you’ll typically need a solid income and positive history of dealing with debt. Before refinancing federal loans, determine whether the above-mentioned benefits apply to you – they won’t transfer to a private lender through the refinance process. But if saving money is your top priority, refinancing may be a great option for you.

Clearly there’s no “one-size-fits-all” approach to determining a student loan repayment strategy. But if you take the time to understand all of your repayment options, you can create a strategy that works best for your situation and potentially saves you money over the long term.

Which allows you to focus on being thankful for your education rather than resenting your debt.